Read This Piece To Learn All About Bank Cards

Posted at by CreditWiz on category Credit CardsCharge cards are helpful tools in building credit and managing money. However, a credit card should not be taken out on a whim, and consumers should always be educated about their cards. This article will provide some basic information about bank cards, so that consumers will find them easier to use.

You must make a habit of paying credit card bills in a timely fashion. All card balances have due dates. If you ignore them, you have the risk of getting charged large fees. You may also have to pay more interest on future purchases if you engage in this behavior.

Purchases with credit cards should never be attempted from a public computer. These computers will store your information. This makes it easier to steal your account. Using your cards on these types of computers is a recipe for disaster. Use only your own computer at home for any and all purchases.

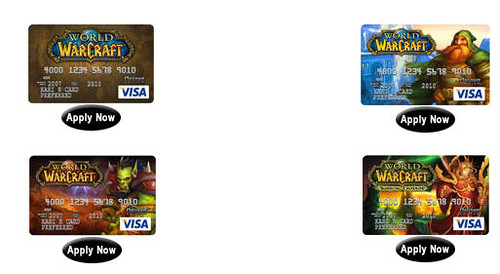

Credit Card

Everyone has had this experience. You receive another credit card solicitation by mail, with an offer for you to apply for a credit card. While there may be occasions on which you appreciate the solicit, odds are, most of the time, you won’t. Shred this mail before throwing it away. This is because many solicitations include your personal information.

It is possible that your interest rate can be reduced, so do not think that you are stuck with the rate you were given. Credit card companies compete with each other for your business, and they all use a range of different rates to attract cusotmers. Make a request to your bank to change your current interest rate if you don’t like it.

It is important that you understand all the new laws governing credit cards. For example, credit card companies may not impose retroactive rate increases. Also forbidden, is double-cycle billing. Educate yourself about credit card laws. Recently, the FCBA and CARD Act were established.

Review the statements you receive from the credit card company very carefully. In addition to unexpected account changes or charges you don’t remember making, check to make sure that all of the charges listed are for the correct amounts. Tell the credit card place about anything that doesn’t seem right. Initiating a dispute promptly can save you money and also help to protect your credit score.

If you rack up more credit card debt than you can afford to repay, you may damage your credit score. This can make it difficult for you to do things like finance a car or rent an apartment in the future. You can find it hard to even find a job or insurance at times.

Make sure to verify all charges and fees that are associated with a credit card that you are considering, instead of just focusing on the interest rates and the annual percentage rate. There are also charges like service charges, cash advance fees and application fees. These can make a card seem worthless if they cost too much.

It is a bad idea to try to get a credit card with a higher spending limit by falsifying your income on the application. Some companies don’t bother to check income and they grant large limits, which may be something you cannot afford.

Annual Fees

If you can, stay away from cards that have annual fees. Annual fee cards are generally not offered to people with good credit scores. These annual fees can negate any advantage of a rewards program. Therefore, it is important to weigh the pros and cons before applying for a credit card with an annual fee. Annual fees are usually found finely written into the terms and conditions of the credit card, not in the promotional materials. Place those reading glasses on. See if the fees outweigh the benefits. Your analysis should dictate your decision.

As said earlier, bank cards can be good and they can be bad. They can help to build a good credit score, but they can also get you in trouble. Knowing how the various cards work is important. You can make more educated choices this way. Grasping the basics of charge cards help consumers make better spending and credit decisions.